Dominus

JUB Addict

- Joined

- Dec 9, 2017

- Posts

- 5,542

- Reaction score

- 605

- Points

- 113

I know quite a few members here are in retirement. I have a question for you about social security benefits.

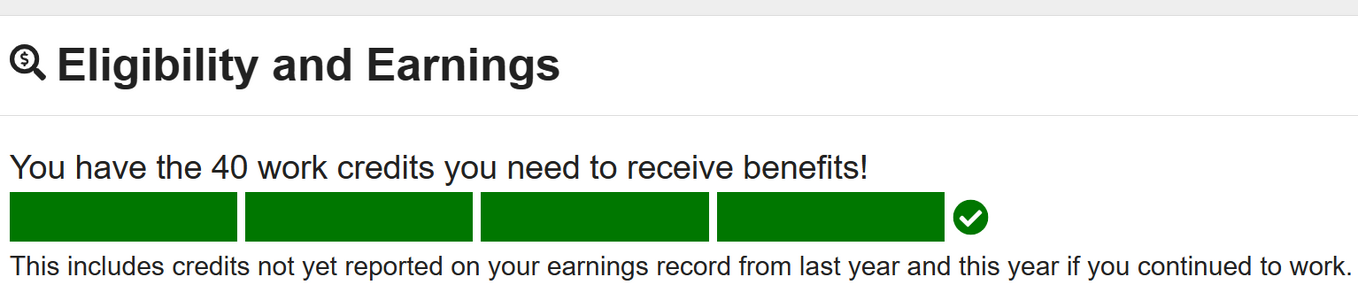

I just created an account on ssa.gov. It says this on there.

I'm in my late 30s. 40 is just right around the corner *sigh*. If I never pay into SS and Medicare taxes ever again, will I be able to draw from SS and be on medicare in my 60s? In other words, will they let me draw from it if I don't pay into it for 25-30 years leading up to retirement age?

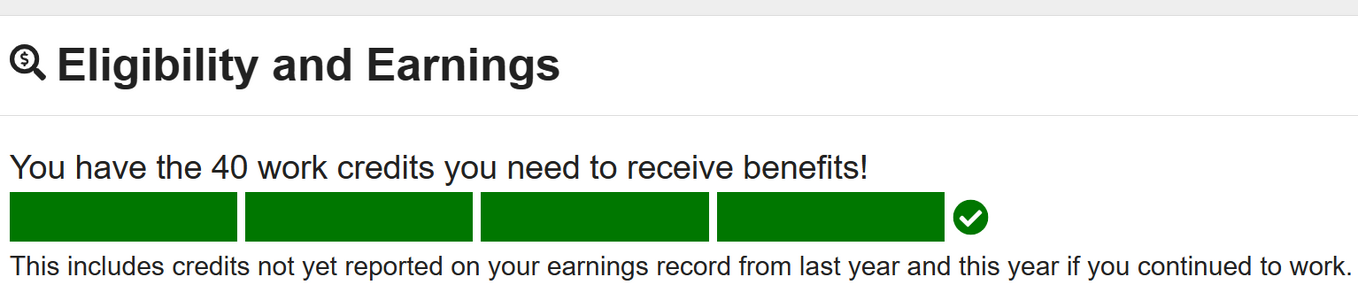

I just created an account on ssa.gov. It says this on there.

I'm in my late 30s. 40 is just right around the corner *sigh*. If I never pay into SS and Medicare taxes ever again, will I be able to draw from SS and be on medicare in my 60s? In other words, will they let me draw from it if I don't pay into it for 25-30 years leading up to retirement age?