Rickrock

JUB Addict

Do you not have working copies?[/QUOTE]

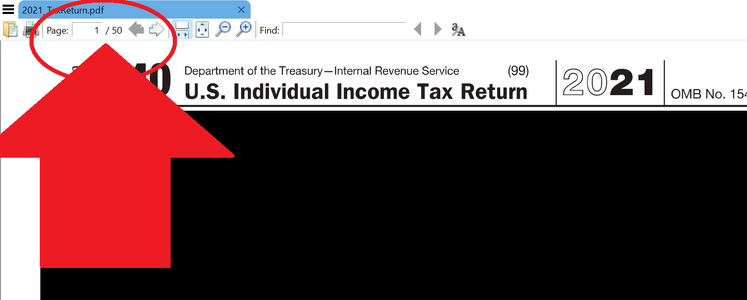

No, they may have when I picked up the forms at the library years ago, but now I print off a copy from the computer. I could print a second copy but don't and in any case if I have more than one figure to add to enter on one line then I have to do the arithmetic before I enter it onto the form.

No, they may have when I picked up the forms at the library years ago, but now I print off a copy from the computer. I could print a second copy but don't and in any case if I have more than one figure to add to enter on one line then I have to do the arithmetic before I enter it onto the form.

](*,)](/images/smilies/bang.gif)