The Original Gay Porn Community - Free Gay Movies and Photos, Gay Porn Site Reviews and Adult Gay Forums

-

Welcome To Just Us Boys - The World's Largest Gay Message Board Community

In order to comply with recent US Supreme Court rulings regarding adult content, we will be making changes in the future to require that you log into your account to view adult content on the site.

If you do not have an account, please register.

REGISTER HERE - 100% FREE / We Will Never Sell Your InfoPLEASE READ: To register, turn off your VPN (iPhone users- disable iCloud); you can re-enable the VPN after registration. You must maintain an active email address on your account: disposable email addresses cannot be used to register.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Rise of Fascism in the United States [SPLIT]

- Thread starter rareboy

- Start date

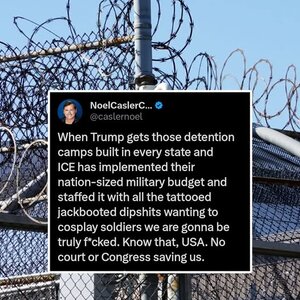

You know what? I warned everyone years ago. I said it over and over and got laughed at and dismissed. Now it is here. Welcome to The Fourth Reich.

They are following the same trajectory, using the same methods, repeating the same propaganda style and even quoting Hitler. They're taking us right down the same path.

"They will make Nazi Germany look like an afternoon garden party."

And people are still in denial and have their heads in the sand.

NotHardUp1

What? Me? Really?

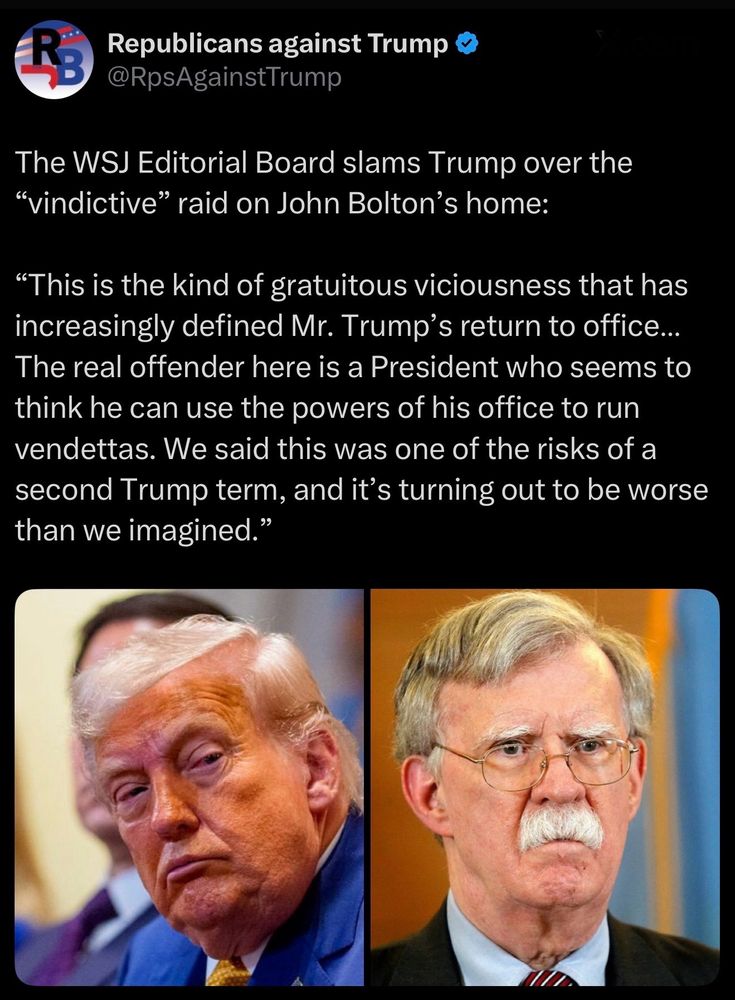

The attack begins on the other Washington:

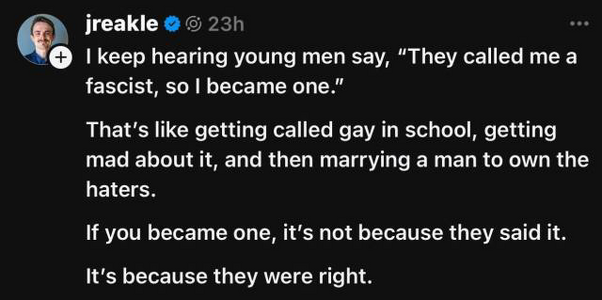

Funny how all the Second Amendment people seems to be really quiet now that a tyrannical

government is taking over the country.

They still think Trump is "owning the libs" for them. When they finally realize they're among those who have been "owned", it will be too late.

- Joined

- Dec 4, 2006

- Posts

- 120,778

- Reaction score

- 32,012

- Points

- 113

At the moment they think they are Trump's militia and still waiting for the order to fire on the blacks, Hispanics, Trans people and Democrats.

But we always knew they were all talk and no action. It was always so easy to talk big while the Dems were in power because they all actually knew that nothing would happen.

It wasn't that they feared tyranny, they just feared people different than them in positions of power.

But we always knew they were all talk and no action. It was always so easy to talk big while the Dems were in power because they all actually knew that nothing would happen.

It wasn't that they feared tyranny, they just feared people different than them in positions of power.

- Joined

- Dec 4, 2006

- Posts

- 120,778

- Reaction score

- 32,012

- Points

- 113

There. The quiet part has now been said out loud.

www.independent.co.uk

www.independent.co.uk

Trump says he is not a dictator but insists many people think the US could use one

President criticized Democratic-led cities of being ungrateful for his administration deploying federal law enforcement to help curtail crime

- Joined

- Dec 4, 2006

- Posts

- 120,778

- Reaction score

- 32,012

- Points

- 113

So basically seizing an interest in a company is now the American way?

Will all the big corporations get the same treatment?

What about Tesla which basically survives through taxpayer subsidies?

Or the Oil Companies?

Or Amazon?

Why only Intel?

Will all the big corporations get the same treatment?

What about Tesla which basically survives through taxpayer subsidies?

Or the Oil Companies?

Or Amazon?

Why only Intel?

- Joined

- Dec 31, 2007

- Posts

- 62,678

- Reaction score

- 16,248

- Points

- 113

It might be time to change this thread title to "Rise of Socialism In The United States".

www.nytimes.com

www.nytimes.com

Meanwhile from the press in India...

Corporate America’s Newest Activist Investor: Donald Trump

The president is demanding government stakes in U.S. companies and cuts of their revenue. Experts see some similarities to state-managed capitalism in other parts of the world.

Corporate America has built up defenses against the likes of Carl Icahn, Nelson Peltz and other corporate raiders who have rattled the cages of chief executives, pushing for higher stock prices. Now companies have a new investor to worry about: the president of the United States.

President Trump has inserted the government into U.S. companies in extraordinary ways, including taking a stake in U.S. Steel and pushing for a cut of Nvidia’s and Advanced Micro Devices’ revenue from China. Last month, the Pentagon said it was taking a 15 percent stake in MP Materials, a large American miner of rare earths.

And on Friday, Intel agreed to allow the U.S. government to take a 10 percent stake in its business, worth $8.9 billion.

These developments could herald a shift from America’s vaunted free-market system to one that resembles, at least in some corners, a form of state-managed capitalism more frequently seen in Europe and, to a different degree, China and Russia, say lawyers, bankers and academics steeped in the history of hostile takeovers and international business.

Meanwhile from the press in India...

In a historic campaign, the Trump family has leveraged Donald Trump’s republican nomination to solidify their previously crumbling business empire, effectively turning around their frightful financial future to amass fortunes reflective of their presidential reign.

When it comes to Donald Trump, wealth is never just a number; it’s a performance. For decades, Trump has thrived on the art of the deal and the spectacle of being rich. Whether it was plastering his name on skyscrapers or hosting prime-time television, his fortune has always been part brand, part reality and part illusion.

Earlier this year, Forbes pegged his net worth at more than $5 billion, a figure that had doubled in just 12 months. By July, The New York Times suggested it could be north of $10 billion. But peel back the glitter, and much of this valuation rests on fragile paper gains —investments that could shrink dramatically if Trump were to walk away. Case in point – Truth Social, one of the companies under the Trump Technology and Media Group that forms one of his largest investments, where his stake is valued upwards of $2.3 billion.

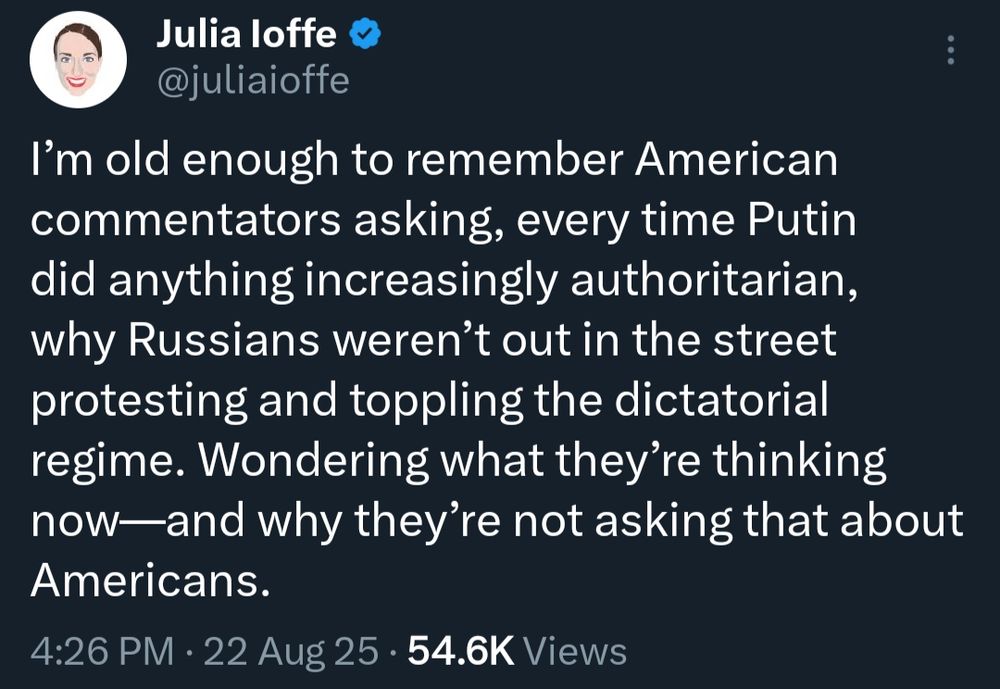

Fascism 101. It's always projection, isn't it. Every accusation is a confession. Accuse the other of side of you would do.

- Joined

- Dec 4, 2006

- Posts

- 120,778

- Reaction score

- 32,012

- Points

- 113

Nicholas Grossman

@nicholasgrossman.bsky.social

"Hard to convince younger generations, but for decades, Republicans went on and on about how two of the worst things imaginable were (1) state intervention in the market and (2) DC using federal troops against US states; both so bad the people should be ready for armed rebellion in case it happens.

- Joined

- Dec 4, 2006

- Posts

- 120,778

- Reaction score

- 32,012

- Points

- 113

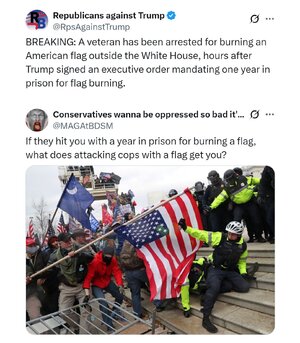

I have to think that this veteran has done the deed in order to get charged and move this into the courts to strike down the EO.

Unftunately, it won't even make it that far to test the legality.

He apparently spent 4 hours being "processed" after the Natl Guard and Park police fought over who has jurisdiction.

Eventually he was charged with "starting a fire in a park" and released.

So it will be a misdemeanour if you set fire to the flag in a public space then.

Unftunately, it won't even make it that far to test the legality.

He apparently spent 4 hours being "processed" after the Natl Guard and Park police fought over who has jurisdiction.

Eventually he was charged with "starting a fire in a park" and released.

So it will be a misdemeanour if you set fire to the flag in a public space then.

Riverrick

JUB 10k Club

- Joined

- Mar 24, 2006

- Posts

- 14,179

- Reaction score

- 780

- Points

- 113

Weird stuff. He lives in a bubble.

NotHardUp1

What? Me? Really?

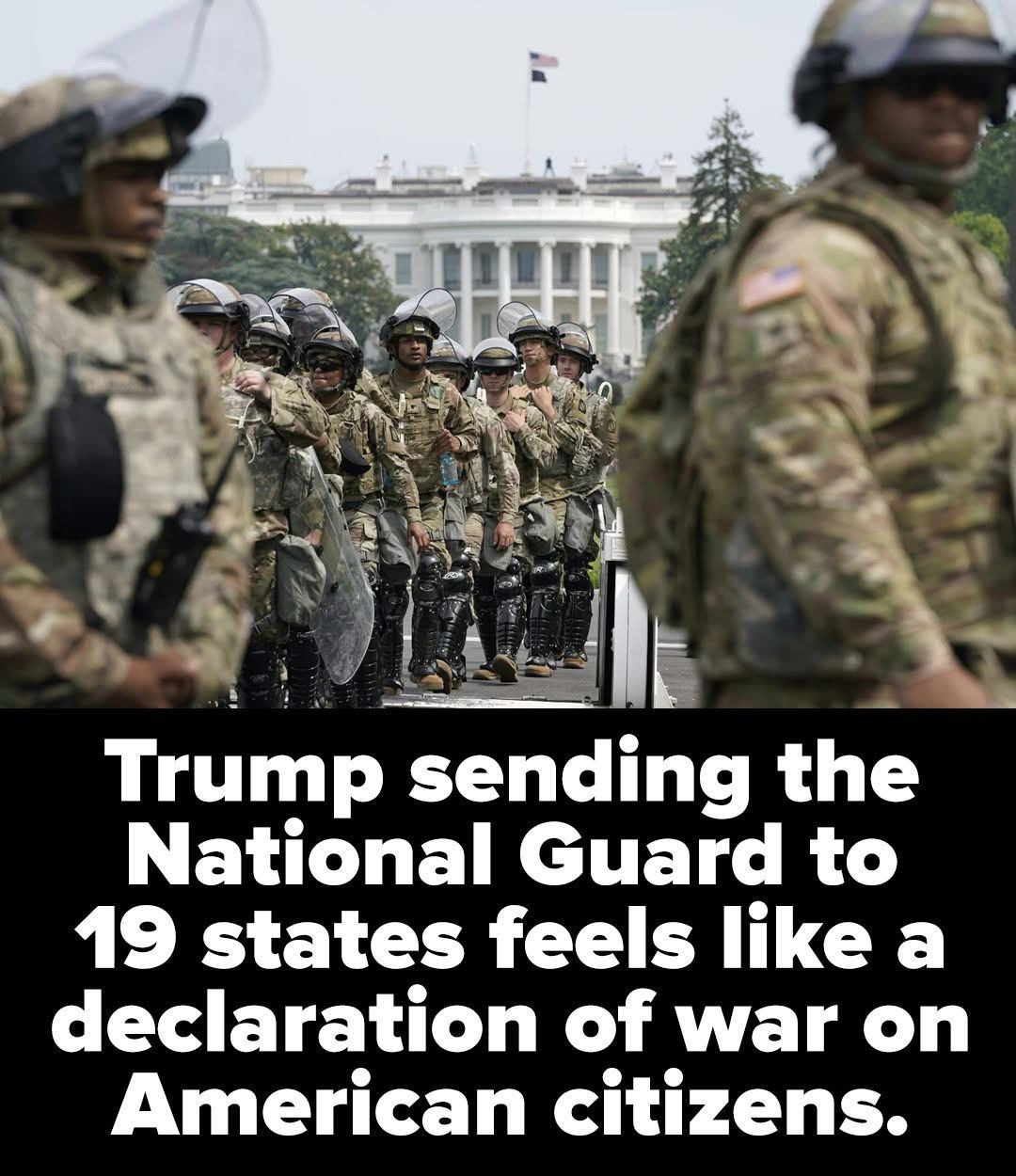

This will soon erupt in snipers and armed conflict. If Congress refuses to check this, or even hold hearings to demand the executive come before them to explain, then it is time to turn on the state and overthrow it. Waiting will only result in defeat.

The governor should order the state police to meet the military at the armories and provoke a military showdown. That extreme action should precipitate a national crisis, in the state legislatures, in Congress, in the courts.

This has become the Central High moment in the fascist coup. The National Guard should have to shoot police and others to take control of citties. Blood will get action.

The governor should order the state police to meet the military at the armories and provoke a military showdown. That extreme action should precipitate a national crisis, in the state legislatures, in Congress, in the courts.

This has become the Central High moment in the fascist coup. The National Guard should have to shoot police and others to take control of citties. Blood will get action.

- Joined

- Dec 4, 2006

- Posts

- 120,778

- Reaction score

- 32,012

- Points

- 113

The most shameful part is that the cabinet continues to play along with this farce. All to preserve their own power and to serve Project 2025 oligarchs and interests and to line their own pockets.

Weird stuff. He lives in a bubble.

The US presidency is now one of the most glaringly and obscenely corrupt farces in the world.

The nation has lost any moral ascendancy or credibility to ever lecture any other country on governance again.

And these people are on record as culpable in this decline and fall.