- Joined

- Dec 31, 2007

- Posts

- 62,039

- Reaction score

- 15,578

- Points

- 113

Something that the media hasn't covered is a fine detail about the presidency: it doesn't have an "expense account". The White House bills the president monthly for the food they eat, the personal items they use and other "non-official" expenditures. One reason that Trump seems to invite people to join him for lunch/dinner is that this makes the meal "official business" which the taxpayers will cover. If he eats alone or with his family, the meal is paid for out of his pocket....Americans should be incensed at having to pay him...

Trump is notorious for not paying bills. It will be interesting to see how getting a bill each month for his expenses is going over.

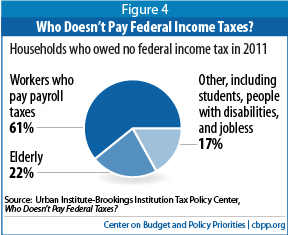

...Most people pay in less than the eventual receive. People who pay only that and not income tax are paying nothing to support the country. The top 20% of tax payers pay 84% of the federal income tax.https://www.google.com/url?sa=t&rct...674384&usg=AFQjCNFMnsSVoGLjoHgbrV_2soNNM_bAQQ

The top 40% pay 106% of income taxes. https://www.google.com/url?sa=t&rct...s.html&usg=AFQjCNGRLe0VvTz_q7dPhjCN5K7sbvUYoQ

One thing that you learn after reading a lot of graduate theses is that it's easy to distort facts by hiding them behind "percentages" and not presenting the actual information.

The percentages you're citing came from two sources- a CBO report and report by the Tax Policy Center. Here's what they're not telling you:

- The "top 20% of income earners" means that your household makes $134,300 per year. For a family of two living in urban areas, that's not a lot of money. As such, 51% of taxpayers are in the top 20% of income earners. In other words, 51% of households pay 85% of the federal taxes.

- The "bottom 20% of income earners" means you make $47,300 per year or less. This is less than 15% of the households in the US. The researcher presented this group as "paying no income taxes" or "paying negative income taxes" by adjusting their taxes paid against the benefits (SSI, food stamps, government assistance, etc) that they receive. This includes a lot of students, retired and disabled people, so it's not exactly a fair presentation to imply that they're not taxpayers since many are retired people who pay state and local taxes but don't make enough to exceed the Federal Poverty Level where one has to pay income taxes.

- Paying 45% of Federal income taxes doesn't mean that this group is paying 45% of their gross income toward taxes. What it means is that these 3 million US citizens are making a shitload of money compared to the other 99% of Americans.

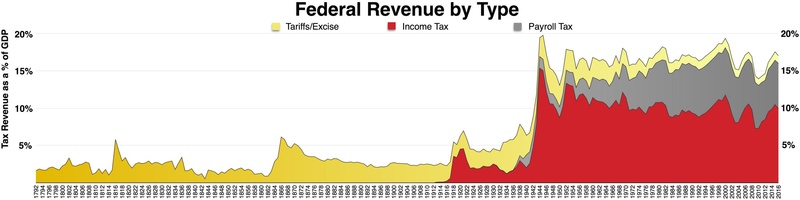

- The amount of Federal income that comes from payroll taxes has been steadily increasing as the rich have gotten richer and the poor have gotten poorer. Our tax system has been progressive for decades- decades in which social unrest has been relatively moderate. History tells us that when the wealthy get wealthier and the poorer get poorer, it's a recipe for social unrest... or even social revolution.

](*,)](/images/smilies/bang.gif)