The Original Gay Porn Community - Free Gay Movies and Photos, Gay Porn Site Reviews and Adult Gay Forums

-

Welcome To Just Us Boys - The World's Largest Gay Message Board Community

In order to comply with recent US Supreme Court rulings regarding adult content, we will be making changes in the future to require that you log into your account to view adult content on the site.

If you do not have an account, please register.

REGISTER HERE - 100% FREE / We Will Never Sell Your InfoPLEASE READ: To register, turn off your VPN (iPhone users- disable iCloud); you can re-enable the VPN after registration. You must maintain an active email address on your account: disposable email addresses cannot be used to register.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

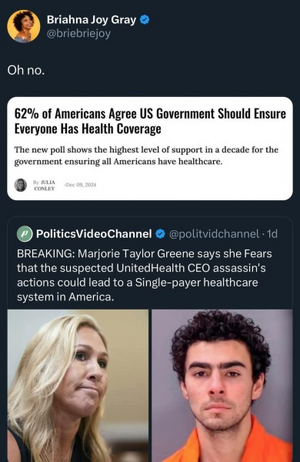

Political Cartoons, Memes & Amusing Videos

- Thread starter opinterph

- Start date

- Joined

- Jan 15, 2006

- Posts

- 122,986

- Reaction score

- 4,539

- Points

- 113

The top tax rat can hit 67% before it has any measurable detrimental effects on the economy, and that's only if it affects more than 1% of taxpayers. For under 0.5%, 85% is no problem.I also thought that after a certain income the tax rate should be 90% although my brother suggested 50% which is more reasonable.

Or that was true over the period from 1950 -- 1990; I assume it's still the case. It may also depend on just where on the income distribution spread that top bracket is set.

- Joined

- Jan 15, 2006

- Posts

- 122,986

- Reaction score

- 4,539

- Points

- 113

have everyone pay what their fair share of taxes is.

Who gets to define "fair share"?

- Joined

- Jan 15, 2006

- Posts

- 122,986

- Reaction score

- 4,539

- Points

- 113

Oh, if only she's right!

What gets me is that large corporations would generally benefit from a Canada-like system in the U.S., but the super-wealthy who run the biggest companies use company money to oppose it.

- Joined

- Dec 31, 2007

- Posts

- 62,728

- Reaction score

- 16,289

- Points

- 113

The problem with your reference to 1950-1990 is that this was when most of those people worked or had ordinary income. These days, the ultrawealthy have so many other means to make money, defer income and have a high net worth without paying payroll taxes like the other 99%. They can also pass on appreciated assets to descendants with a low tax rate because the Trump tax cuts of 2017 doubled the exemption to $14 million ($28 million for couples) and created additional ways to shelter estates to avoid the 40% tax rate for amount exceeding the exemption.The top tax rat can hit 67% before it has any measurable detrimental effects on the economy, and that's only if it affects more than 1% of taxpayers. For under 0.5%, 85% is no problem.

Or that was true over the period from 1950 -- 1990; I assume it's still the case. It may also depend on just where on the income distribution spread that top bracket is set.

Until all income is treated as ordinary income (or Chuck Schumer, Kristin Gillibrand and the rest of the NY Congressional delegation decide to not accept Wall Street donations), it will never happen.

Since the Orange Supremacist was re-elected and both Houses of Congress have Republican majorities, they will extend all of those tax cuts for the wealthy using reconciliation and there's nothing that Democrats can do about it.

Last edited:

- Joined

- Jan 15, 2006

- Posts

- 122,986

- Reaction score

- 4,539

- Points

- 113

The problem with your reference to 1950-1990 is that this was when most of those people worked or had ordinary income.

Well, yes. So stock options, capital gains after the first $120k, and dividends after the first $120k should all be taxed as ordinary income.